And so Trump does it again. He saw that the market was getting more nervous. He saw what happened to stock futures on Wednesday evening/Thursday morning when they collapsed overnight — the Dow was down better than 300 points soon after midnight. So he begins the process of tweeting — taking it all very slowly, teasing the markets, and teasing the South China Morning Post (SCMP), contradicting what was being reported and contradicting the building speculation about “failed meetings” even before there WAS a meeting.

He successfully helped to turn the futures around during the night to find them almost unchanged by 9:30 am yesterday morning. And then we get benign economic data — weaker CPI and weaker average hourly earnings — and that caused futures to rally just a bit more. As the opening bell rang the markets surged and then he “hits the golden buzzer” and BOOM! Algos out of control as they all ran each other over vying for the optimal spot. What was it that caused the commotion? What was it that took the algos to the point of no return?

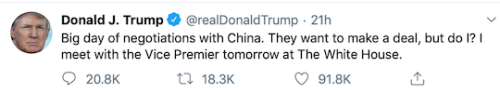

This tweet! Simple, not difficult to understand and launched at precisely the exact moment to produce the biggest impact…

Notice what went on here. He announces a BIG DAY, he announces that THEY WANT TO MAKE A DEAL (contrary to what they had been saying all night), and then he puts himself in the driver’s seat by saying ‘BUT DO I?” He then seals the deal with the fact that he is meeting the Vice Premier TOMORROW AT THE White House…. Did you get that? Tomorrow means FRIDAY – And this is where he ties it up again.

All night long we heard how the Vice Premier was leaving on Thursday, cutting his stay short, not attending the White House dinner, frustrated with the process and this is what had set the markets ablaze overnight. But when Donny conveniently tweeted out his news – the algos didn’t know what to do, then blew up and sent the Dow up some 240 pts, the S&P up some 28 pts, Nasdaq up 78 pts and the Russell up 12 pts. I mean, you can’t make this up!

Now again, the market is rallying on the idea that the Chinese may consider a “trade lite” deal suggesting that the market and investors WANT something. They realize they are not getting everything, but something would be fine. And again, that is what happened yesterday. The idea that Trump was meeting the Vice Premier on Friday (after he threatened to leave on Thursday) was seen as a positive.

So, after all the excitement, the markets calmed down a bit, backed off those early morning highs as they digested the news, with everyone remaining cautiously optimistic. Rumors that the White House is trying to roll out a currency pact as part of any preliminary deal was seen as positive — and overnight the Chinese announced that they may be willing to back off of state-owned interests in foreign banks (that headline is still unfolding). So the sense is that maybe the White House will suspend the tariff increases set for the 15th. By the end of the day the Dow was ahead by 150 pts or 0.57%, the S&P gained 18 pts or 0.64%, the Nasdaq was up 47 pts or 0.60% and the Russell added 6 pts or 0.40%.

Next up are earnings and this is going to be the new hurdle for the markets and investors. Was Delta (DAL) the canary in the coal mine? Strong 3rd qtr, – missed on top but beat on the bottom line. They returned $468 mil to shareholders thru divys and share buybacks and announced the 26th consecutive qtrly dividend, saw domestic, Atlantic and LATAM revenues surge, while Pacific revenues missed. And while they expect a strong 4th qtr – in the range of $1.20/$1.50 share – the current consensus expectations are for $1.51/share.

So THIS was the canary. Are we going to see CEOs and CFOs offer lower guidance going forward than what the street already expects for the 4th qtr and into 2020? (Of course, we are…) And that did not sit well with the algos. But right now, it’s all about trade…Capisce?

Now the official earnings season kicks off on Oct. 15 with the release of the JP Morgan (JPM) results – the first DOW stock to report. Expectations call for $2.46/share. So stay tuned. Behind JPM will be BLK, GS, C, WFC, BAC, MS…

Overnight, the surge continued in Asia and is continuing in Europe… HOPE IS ALIVE and now on two fronts: 1. Trade and 2. BREXIT. Investors and markets are certainly breathing a sigh of relief over trade and look forward to today’s meeting at the White House between Trump and He. Expect more trade news later today from the Rose Garden. The announcement today that the Chinese are buying more soybeans and more pork is a positive. But let’s be real – THEY NEED THESE ITEMS… their atmosphere is a disaster. Who wants to eat any of the food they produce? Now, any deal or any part of a deal would be a positive as it will certainly delay the imposition of the next round of tariff increases. Japan + 1.15%, Hong Kong + 2.34%, China + 0.96% and ASX +0.91%.

In Europe, markets are also in rally mode with most centers up more than 1%. Irish PM Leo Varadkar (commit this name to memory as he appears to be playing a more high-profile role in this drama) announced that a BREXIT deal ‘could be clinched by the end of October to allow the UK to exit the European Union in an orderly manner’.

All kinds of meetings taking place – UK BREXIT Secretary Stevey Barclay is in talks with EU Chief BREXIT Negotiator Mikey Barnier right now and JPM chimes in and raises the odds of a deal by Oct. 31 from 5% to 50%. So, it’s nothing but GOOD news around the world – (for the most part – see below — OIL). FTSE +0.23%, CAC 40 +1.09%, DAX +1.79%, EUROSTOXX +1.32%, SPAIN +1.80% and ITALY + 0.84%.

US futures are on FIRE… Dow up 248 pts, S&P’s up 31, Nasdaq rising by 83 and the Russell is ahead by 20 pts all because Donny and He are lunching at the White House as they try to move the ball down the field and come to a “trade lite” deal — something that at least leaves the door open to further negotiations. It is clearly RISK ON — and the algos are having a party. Sell side liquidity has disappeared leaving a void in inline supply causing the surge…

The S&P has now exploded higher and this morning we can expect it to charge right thru resistance at 2950. Any positive news (more than we already have) will cause the algos to take the mkt right back to the century mark – 3000. So sit tight…

Oil — up by 1.5% as Iran announces that one of their tankers got attacked by a mystery missile off the coast of Saudi Arabia (not sure about you, but something stinks here). The tanker traveling off thru the Red Sea was apparently minding its own business and just cruising along when it suddenly got hit by a missile. The Saudis have nothing to say and the Iranians said this (now the implication WAS that the Saudi’s are responsible, but the Iranians have dialed back on that accusation as of 7:20 am):

“Those behind the attack are responsible for the consequences of this dangerous adventure, including the dangerous environmental pollution caused.”

And all this does is raise the temperature in an already hot region of the world. The surge in oil today takes it up 90 cts/barrel to $54.44. Again, nothing like it would have been 10 years ago. No one is nervous about supply, but they are anxious about how this could quickly spin out of control.

Take Good Care,

KP

Warm Brownie a La Mode

You know when you’ve just had it and you need to eat something that makes you feel good? This is it.

Warm Brownies and a big scoop of vanilla Ice Cream – add some warm Hershey’s chocolate sauce and crushed walnuts.

Enjoy the weekend.

Buon Appetito.